The Obama administration is quietly gearing up for a high-profile launch in May or June on what may turn out to be the most heavily lobbied issue of the year: corporate tax reform.

“This will be a feast for K Street,” said one top aide.

At a time when the two parties can find little common ground legislatively, strategists on both sides tell POLITICO they hope to advance their jobs agenda by finding a way to lower corporate tax rates.

“This would send a reassuring signal to the economy, and is something both parties should support in theory,” a senior administration official said, predicting “a numbers game” in which companies and industries ferociously litigate the fine points.

Treasury Secretary Timothy Geithner plans to ignite the debate by unveiling a white paper that advocates lowering the top corporate tax rate from the current 35 percent to less than 30 percent and as low as 26 percent, according to aides. The proposal is likely to fall between 26 percent and 28 percent.

To pay for that, the proposal will call for closing loopholes and slicing exemptions. The two main ones are a tax deduction for domestic manufacturing and accelerated depreciation for capital equipment.

Got that? Reducing corporate taxes is a "jobs agenda." Pervasive unemployment, a housing market in a continued tailspin, GDP in the shitter and barely strong enough to keep us from backsliding into another recession, and Washington's idea of an economic priority is...corporate tax reform. But it would send a reassuring signal to the economy, and we all know how important it is to stroke the delicate fee-fees of the economy (and our plutocrats) while categorically ignoring the economic hardships of millions of Americans. I hear markets get a real boner for that kind of thing. And why shouldn't we tackle corporate tax reform? You know, because our poor, beleaguered corporations are just struggling so hard right now! They can't compete or innovate globally with our punitive Highest Tax Rate in the World!

All told, the Fortune 500 generated nearly $10.8 trillion in total revenues last year, up 10.5%. Total profits soared 81%. But guess who didn’t benefit much from this giant wave of cash? Millions of U.S. workers stuck mired in a stagnant job market. [...] Nevertheless, we’ve rarely seen such a stark gulf between the fortunes of the 500 and those of ordinary Americans.

And they are now even considering the much maligned, corporate giveaway that creates zero jobs, unless you define jobs as bonuses for executives and dividends for shareholders.

One possibility for the administration white paper is a move toward a more territorial system that is consistent with taxation schemes in the rest of the developed world, focused on taxing profits earned in the U.S. Such a provision would probably include a transitional measure that allowed companies to move profits earned abroad back to the U.S. at a lower tax rate — say, 10 percent.

It's amazing what a few million dollars in lobbyists can buy you, and it's maddening to watch them fuss over lowering the marginal rate when pretty much zero corporations actually pay the top marginal rate to begin with. Whatever the "grand bargain" ends up being, expect it to be supremely corporation-friendly and likely put them in a position to be paying even less than they are now. The Chamber of Commerce will send their army of lobbyists in and crack the whip at their foot soldiers in Congress, who will promptly do their bidding, sell it as an enormous bipartisan success, and then head off to a cocktail party to discuss the intricacies of their post public service employment in the same companies to which they just gave an enormous slobbery legislative blow job.

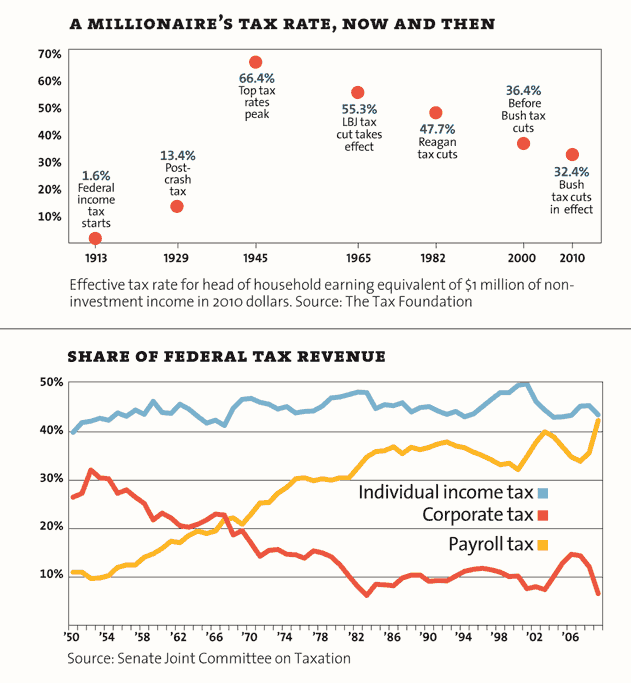

There's no shortage of reasons why this is completely ridiculous, one of them being that corporate taxes as a share of federal revenue are at record lows:

And the evil socialists at the Congressional Budget Office have found that a significant number of American corporations pay no taxes at all:

But by taking advantage of myriad breaks and loopholes that other countries generally do not offer, United States corporations pay only slightly more on average than their counterparts in other industrial countries. And some American corporations use aggressive strategies to pay less — often far less — than their competitors abroad and at home. A Government Accountability Office study released in 2008 found that 55 percent of United States companies paid no federal income taxes during at least one year in a seven-year period it studied.

I'm not saying that the current system is perfect. But it's disgusting to focus on corporate welfare while millions are struggling, even if you try to assuage what's left of your conscience by couching it in an enormous pile of horse shit by calling it a jobs program.

No comments:

Post a Comment